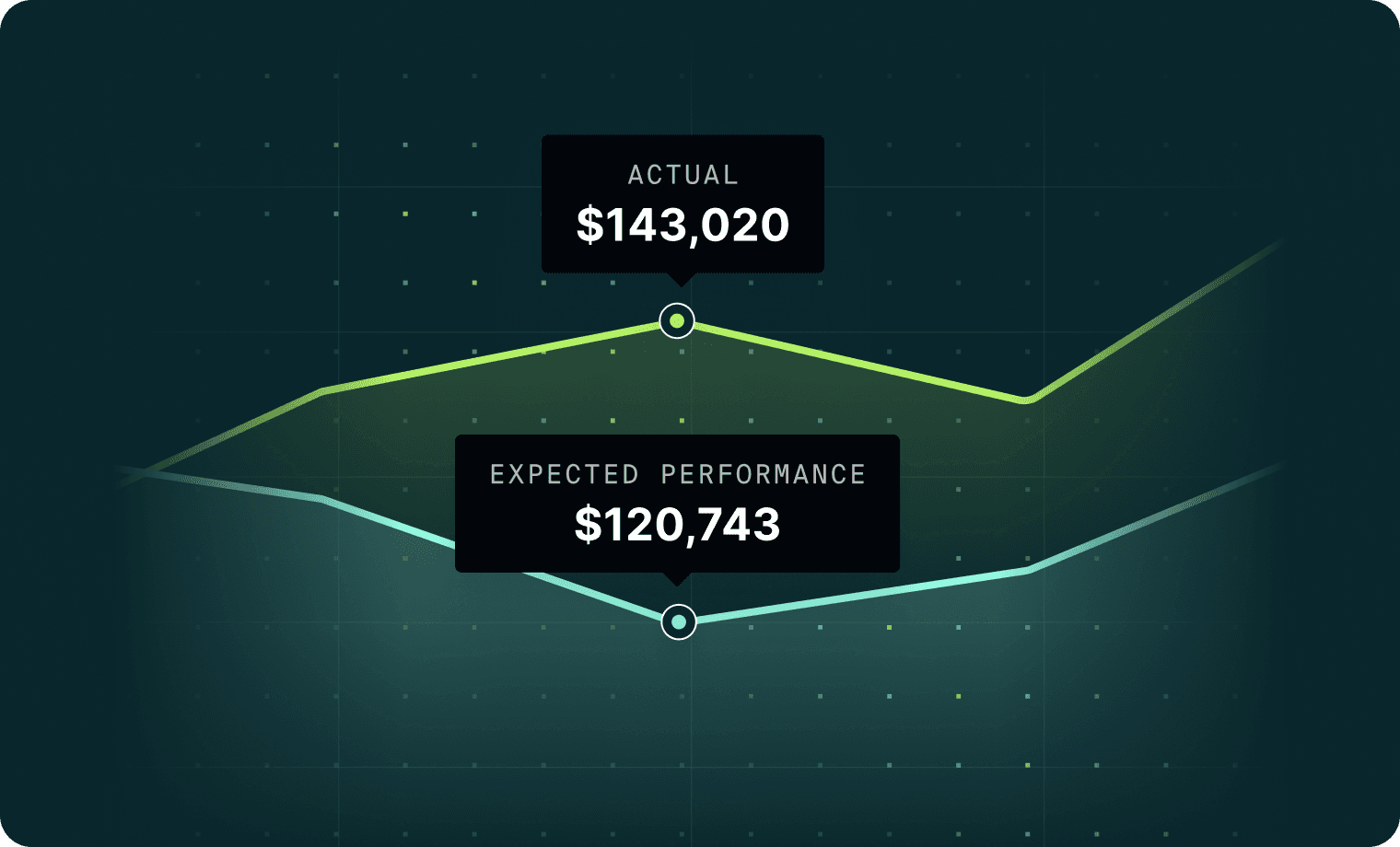

The Differences Between Actual and Expected Performance

One of the most powerful ways an FP&A team can improve the trajectory of a business is by achieving a deep understanding of the differences between actual and expected performance, and making actionable and relevant recommendations based on that analysis.

This involves incorporating some key concepts into the process:

-

Real understanding is real-time

-

Real understanding is holistic

-

Be open to the unexpected

-

Technology can empower human expertise to reach a new level

-

Success needs involvement and buy-in from elsewhere in your organization

In this article we’ll go through each concept, and explain why it’s so vital for FP&A teams in understanding the differences between actual and expected performance.

Real Understanding is Real-time and Holistic

Markets, customer behaviors in fast-changing environments, technological evolution and more seem to change faster every year. Finance teams are under pressure to adapt, and FP&A teams often feel this particularly acutely.

Differences Between Actual and Expected Performance Need to Be Seen in Real Time

Planning, forecasting and budgeting all require grounding in the reality that exists now, not the one that was familiar last month

All this means that data needs to be sourced in real time. When changes happen, you need to see that reflected straight away, to be able to calculate how it interacts with other relevant factors, and what the outcome might be.

Example: A supply chain issue might impact logistics, operations, procurement, pricing, production, customer service and more. The sooner you’re alerted to the problem and source all possible data about it, the faster you can calculate the probable impact and move to mitigate it.

FP&A platform’s like Firmbase’s have evolved in tandem with the need to shift to real-time data to enable teams to gather data in real time from multiple sources and centralize them in a way that is easy to work with and analyze.

Differences Between Actual and Expected Performance Require a Holistic Perspective

When we talk about variance, there’s a wide variety of areas that might be involved. You might be considering material variance, sales variance, overhead variance, labor variance, efficiency variance and so on. While these may be treated as separate categories for the purposes of calculation, they often interact with each other.

Example: If you hire a group of workers who are less skilled or efficient than expected, your goods will likely take longer to produce than predicted, you may use more material than anticipated (due to mistakes made by the workers) and the quality of the output may be impacted as well, which could in turn have a knock on effect on sales in the medium term.

In the same way, you’ll need to be able to put that story into the context of different departments. Here are just a few of the questions you might dig into:

-

Was there a change in recruitment policy or personnel that led to the hiring decision?

-

How is the increased amount of material being used affecting existing agreements with suppliers?

-

What might the future impact be with suppliers?

-

Is there an impact on relationships with clients?

-

Has feedback been received about this? If so, what impact has that had on customer support?

-

Is there a reputational impact? If so, among what audience?

Looking at any single element in silo provides such a limited picture that it can be actively misleading, resulting in unhelpful recommendations.

Be Open to the Unexpected

The simplest explanation is often best. But simple doesn’t mean predictable. Sometimes the difference between actual and expected performance comes from a surprising direction. Teams that only follow a set path of investigation may miss the reality.

For instance, if you experience an unexpected surge in sales, you may naturally look to your marketing or sales processes and campaigns. But the real reason behind the surprise success might be that a product you sell was featured, without your prior knowledge, in a popular TV show, or that a competitor has been having production problems.

If you lose more employees than expected in a period, it may be due to market trends (as in what was referred to as “the great resignation”) or because a competitor is investing in poaching from others in the field, rather than internal factors.

If production is slower than expected one month, perhaps something as surprising as insects or local fauna might be part of the reason. (It has happened!)

Communication with the employees on the ground and in the relevant departments is key. Numbers are the foundation – but they only tell part of the story. Be open to the unexpected.

Learn how Firmbase automates up to 80% of your manual FP&A workload.

Technology Has Changed What is Possible for Understanding the Differences Between Actual and Expected Performance

The challenges of demands that FP&A teams face today in understanding the differences between actual and expected performance are greater than ever before.

The need to look at more data than ever, closer to real-time than ever, from across more departments and in many cases many geographies, makes the picture complex as well as detailed. This added complexity makes it even more vital to ensure all understanding is grounded in data.

Handling this amount of data is too much for manual processes and calculations, which is why many FP&A teams are leaning into leveraging technological advances to assist them in order to:

-

Expand the scope of the data they can handle.

-

Ensure data from systems and platforms from across the company are brought together in one centralized place for analysis.

-

Avoid manual errors in complex comparisons and calculations.

-

Create visualizations to aid understanding and presentation.

With systems such as Firmbase’s FP&A platform to streamline and lighten processes and burdens, FP&A professionals are able to make the most of their expertise and skills in the areas that cannot be replaced by technology. It’s more fulfilling, more efficient, and provides greater benefit for the company.

You Understood the Difference Between Actual and Expected Performance? Don’t Keep it to Yourselves

To maximize the benefit of the process of understanding the difference between actual and expected performance, teams need to ensure that they proactively share insights with relevant stakeholders.

This often includes:

-

Other members of the finance department

-

Business executives or leadership

-

Business partners and budget owners across the organization

There are a number of elements to bear in mind as part of the communication process, including:

-

Thank people and departments for efforts made to help you source, standardize or interpret data.

-

Communicate your findings clearly and concisely, with visualizations or illustrations as appropriate to aid understanding.

-

Solicit input and opinions regarding open questions that are relevant to other departments, or that require complex solutions where external expertise may be valuable.

-

Respectful communication of issues uncovered that led to variance.

-

Discussions around possible directions for strategy, based on the insights.

-

End with clear, actionable next steps, with specific departments (and if possible, individuals) responsible for executing them.

How to Ace Understanding the Difference Between Actual and Expected Performance

To understand the difference between actual and expected performance, make sure that you:

-

Use real-time data.

-

Operate according to a holistic perspective.

-

Remain open to the unexpected.

-

Leverage technology to empower human skills and expertise.

-

Communicate your findings effectively.

-

Turn insights into actionable next steps.

Further Resources

To find out more about understanding the difference between actual and expected performance, check out this guide.

For an overview of how to improve FP&A outcomes using budget variance analysis, read this article.

To ensure you’re avoiding 5 common mistakes in the process, take this checklist into account.