What's the Difference Between Budget vs Forecast vs Actual?

We’ve written before about budget versus actual, what the difference is and why it matters. We’ve even put together a guide as an explainer. FP&A teams spent a lot of time on BvA, because that process is a key way they evaluate the financial performance and health of their company, and make relevant actionable suggestions to strengthen this in the future. What’s sometimes confusing as part of this is the difference between budget versus forecast versus actual.

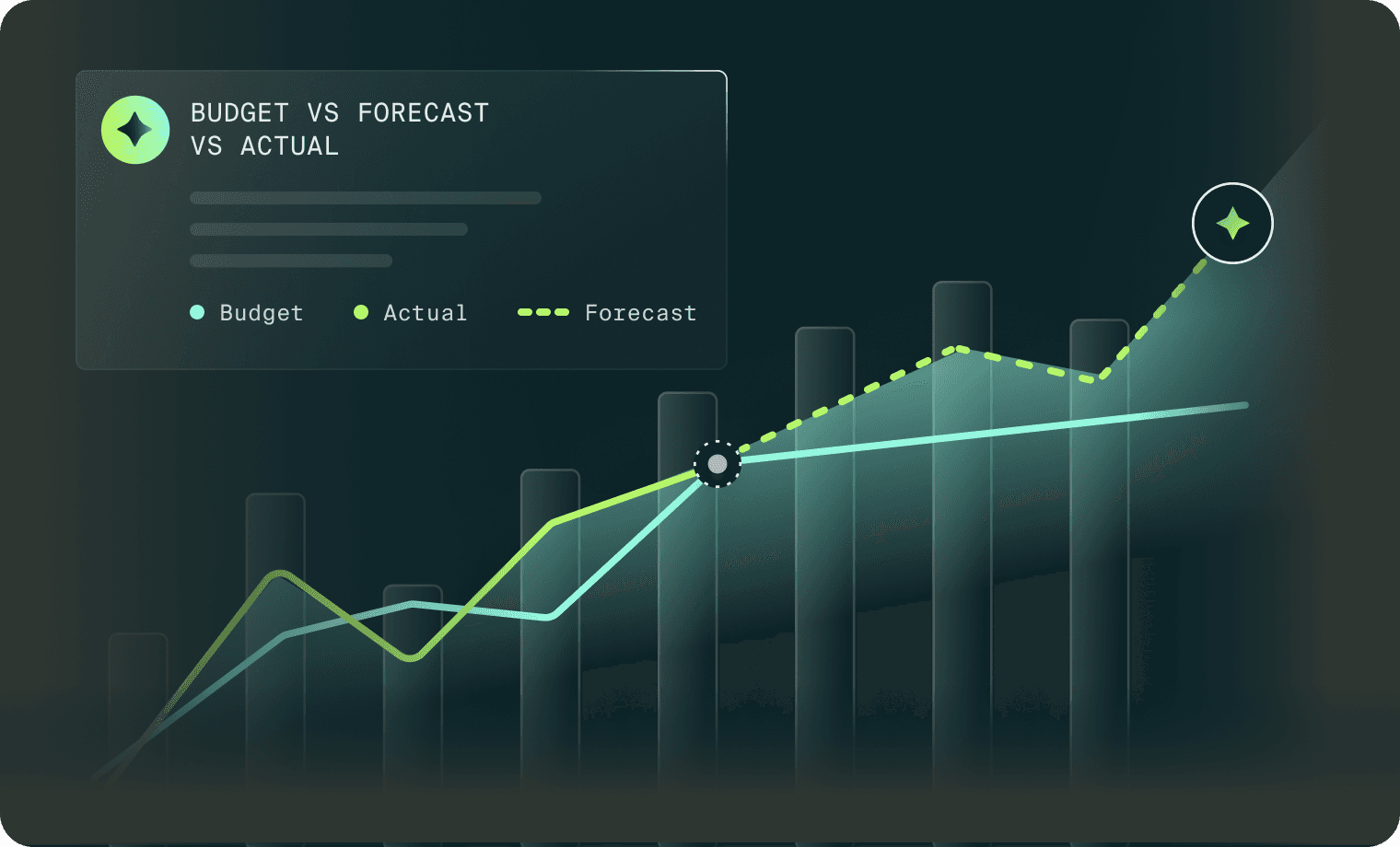

Budget vs Forecast vs Actual

The reason there is sometimes confusion between the terms budget, forecast and actual and how they interact is that they are all part of the same analytical process. One of the ways financial professionals bridge the gap between budget and actual performance is through forecasting.

-

You could think of a budget as a mechanism of goal-setting and control. Each department and team (after a collaborative process) receives direction about what they have to spend, and what they are expected to produce. The company budget, pulling all of this together, shows the goals, parameters of resources, and expected results of the organization.

-

No one wants to check in after a year to discover that every department is miles off from their budget. In order to track how closely your predictions are matching reality as you go along, and to adjust course for the details of different paths and strategies your company might use to get to the right results, you use forecasting.

-

If you have an annual budget, but a monthly or quarterly forecasting analysis, you will be comparing the monthly or quarterly reality to the numbers you had predicted; you’ll be comparing forecast to actual.

-

In the same way, at the end of the year, you’ll compare your budget to what really happened; you’ll be comparing budget to actual.

In an important way, it doesn’t make sense to think about these terms in isolation. They are connected in complex ways that reflect the huge number of variables that might impact your business results. Internal and external factors may all influence a gap between budget and actual, and forecast and actual, and determine what you recommend based on forecasting to try to limit the gap between budget and actual.

Budget, Forecast and Actual for FP&A Teams

Forecasting could be thought of as a fine-tuning method used by FP&A teams to work out, mid-race, why there’s an unexpected gap in performance, where it’s coming from, how it is likely to impact the actual result compared to the budget, and what strategies could be employed to correct the divergence that’s being observed.

If the results by the end of Q1 are very different to what had been put in the budget, it might be that robust analysis of the causes of this variance could lead to effective changes in strategy. As a result, by the end of Q3, the variance could be minimal, and by the end of Q4, budget and actual performance have little discrepancy. This would be an example of using forecasting to reduce budget variance, and a good way to think about budget vs forecast vs actual in practice.

The emergence of dynamic forecasting, or continuous planning, has made forecasting a particularly potent weapon in both business insight and reducing variance. With the advent of AI and dedicated FP&A platforms like Firmbase, which pull all the relevant data together in one place in real time, teams can analyze business financials almost instantaneously.

Modern continuous planning methodologies also help reduce the time required for analysis, which was once a strain for many teams, helping to determine the best course of action for the business based on existing current reality.

Make Budget vs. Forecast vs. Actual Into a Business Asset

Understanding the differences of budget vs forecast vs actual is only a first step. Employing that understanding can be a tremendous asset for a company.

Budget variance analysis, which combines all three aspects, can be a powerful tool for protecting a business from unexpected loss, and encouraging positive growth. FP&A teams that leverage it appropriately can have a significant impact on their company’s results.

Teams that take proactive steps to avoid common mistakes that can limit the scope or effectiveness of the process can ensure that their insights into the differences between budget, forecast and actual results benefit the organization on every level.

For this to be most impactful, it must be embedded in a strategy that guides the budget, forecast and actual evaluation and analysis process on an ongoing basis.

Book your demo today to learn how Firmbase will help you create budgets, run forecasts & analyze important financial insights.