Top Five Reasons FP&A Teams Should Quit Spreadsheets

Financial Planning & Analysis (FP&A) teams provide essential insights at any organization. However, many still rely on spreadsheets to manage data and analyses. While spreadsheets have been the go-to for finance professionals for decades, they’re not suited for modern FP&A. In this blog post, we will explore the top five reasons not to use spreadsheets for FP&A.

Limited scalability

Spreadsheets are essentially unchanged since the software was launched in the 1980s. They were never designed to handle large data sets or complex analyses. As FP&A teams grow and the amount of data they need to manage increases, spreadsheets quickly become unwieldy and difficult to manage. Data entry errors, formula errors, and data integrity issues are common in spreadsheets, making it difficult for FP&A teams to trust the accuracy of their analyses. Moreover, as the size of the data set increases, spreadsheets become slow, making it difficult to perform real-time analyses or generate reports quickly.

Lack of collaboration

FP&A involves multiple stakeholders including finance teams, executives, and department heads. Spreadsheets make it difficult for individuals to collaborate effectively as they require manual updates and sharing via email or other communication channels. This leads to version control issues, where different stakeholders are working on different versions of the same spreadsheet, causing confusion and errors. Moreover, spreadsheets lack the version control features and audit trails necessary to track changes and ensure data accuracy.

Limited reporting capabilities

Spreadsheets are not designed for reporting, making it difficult for FP&A teams to generate reports that are meaningful and actionable. Spreadsheets require manual formatting and data manipulation, which is time-consuming and error-prone. Moreover, spreadsheets lack the ability to generate interactive reports or visualizations that provide insights into the data. This makes it difficult for FP&A teams to communicate their analyses effectively to stakeholders, leading to misinterpretations and misaligned expectations.

Increased risk of errors

Spreadsheets are prone to errors, which can lead to significant risks. Data entry errors, formula errors, and formatting errors are common in spreadsheets, making it difficult to trust the accuracy of the data. Additionally, spreadsheets lack the necessary controls and governance processes to ensure data accuracy and prevent errors. This can lead to compliance issues and financial losses, putting the organization at risk.

Lack of integrations

Data creation and management has changed significantly since spreadsheet software first arrived on the scene decades ago. FP&A teams need to integrate with other systems and platforms to perform effective analyses. This can lead to data inconsistencies and errors that can impact the accuracy of the analyses.

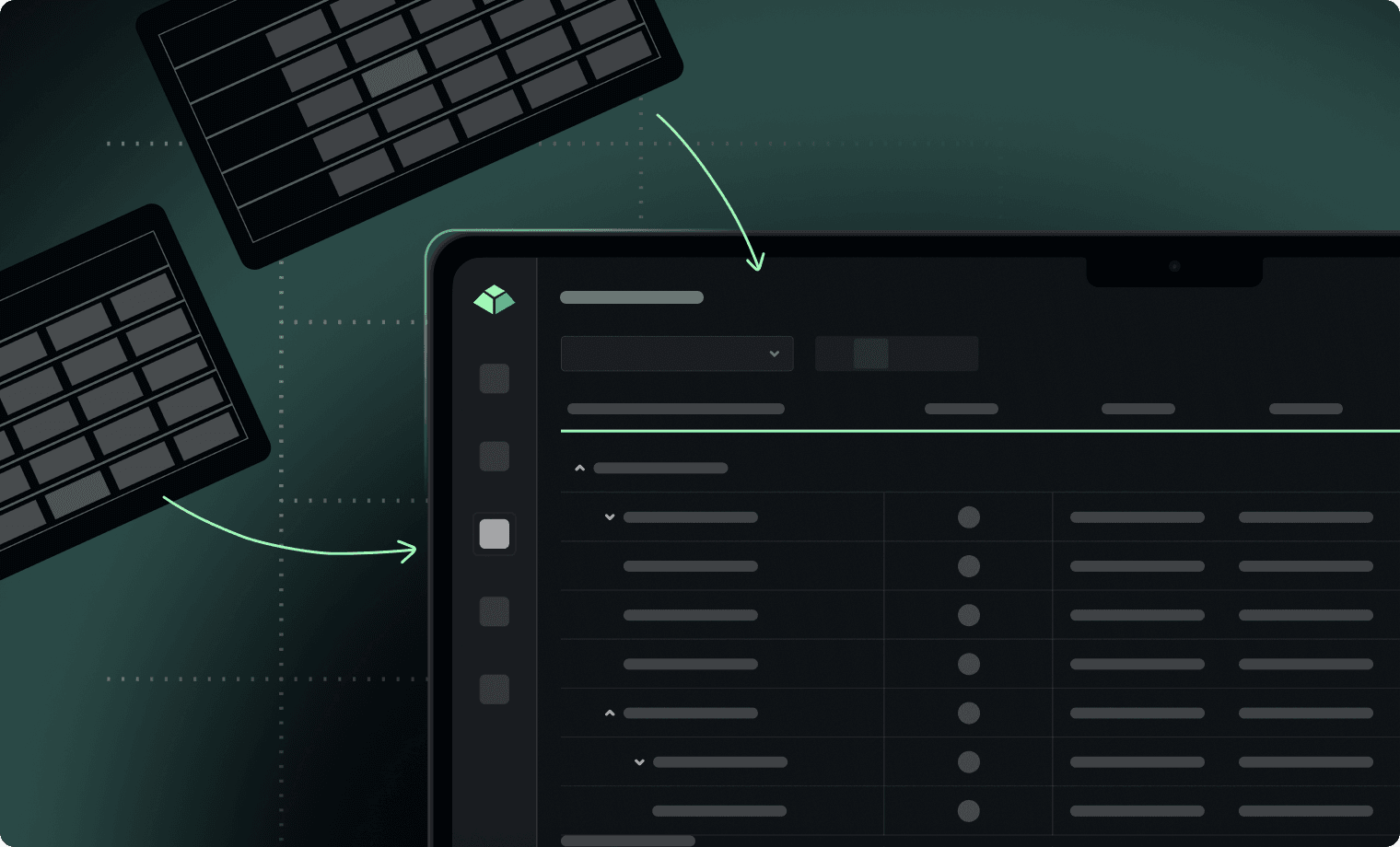

While spreadsheets have been the go-to tool for finance professionals for decades, their drawbacks are considerable. Users run the risk errors, and are unable to integrate with other systems. For these reasons and more, FP&A teams are increasingly looking for advanced, dedicated software like Firmbase.io. To succeed in today’s digital age, FP&A teams need to leverage modern technologies that are designed for large-scale data management, collaboration, reporting, and integration.